Personal finance fbla practice test – Embark on a comprehensive exploration of personal finance with the FBLA practice test. Delve into the fundamentals, savings and investments, credit and debt management, financial planning, and consumer protection, gaining invaluable insights to navigate your financial journey.

This practice test is meticulously crafted to equip you with the knowledge and skills essential for making informed financial decisions. Prepare yourself for success in the FBLA competition and beyond.

Personal Finance Fundamentals

Personal finance encompasses the management of an individual’s financial resources to achieve financial goals and maintain financial well-being. It involves budgeting, saving, investing, credit and debt management, and financial planning.

Budgeting is a crucial aspect of personal finance, as it helps individuals track their income and expenses, allocate resources effectively, and achieve financial goals. Common budgeting methods include the 50/30/20 rule, the envelope system, and zero-based budgeting.

Saving and Investments, Personal finance fbla practice test

Saving money is essential for financial security and achieving long-term goals. Different types of savings accounts, such as checking accounts, savings accounts, and money market accounts, offer varying levels of liquidity and interest rates.

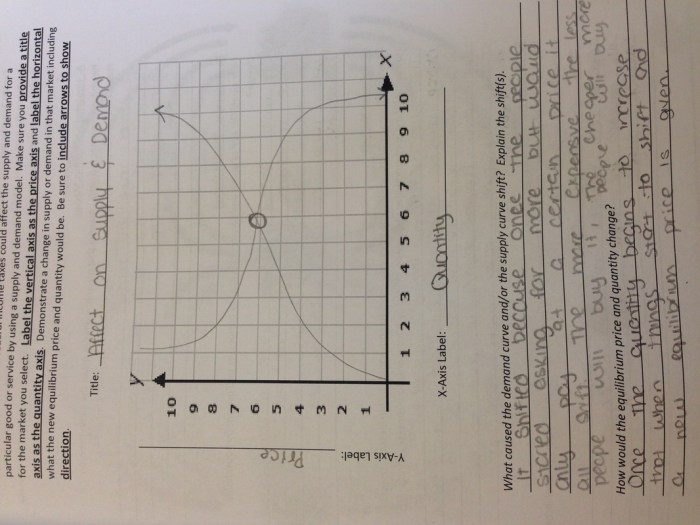

Investing involves allocating funds into assets with the potential for growth, such as stocks, bonds, and mutual funds. Diversification, the spreading of investments across different asset classes and sectors, plays a vital role in managing risk.

Credit and Debt Management

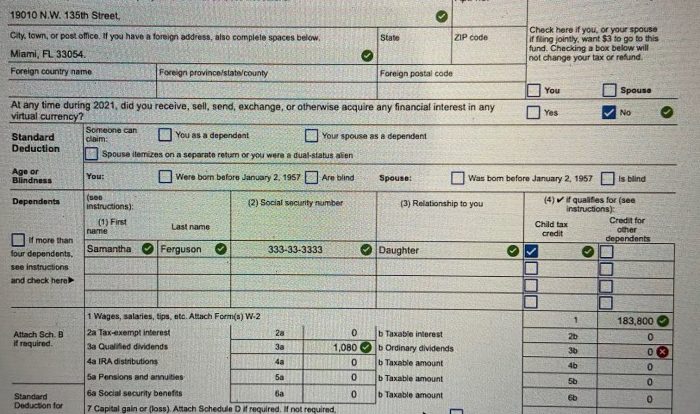

Credit is a powerful tool that can facilitate access to goods and services. However, it’s crucial to use credit responsibly, understand interest rates, and avoid excessive debt.

Debt repayment strategies, such as the debt avalanche method and the debt snowball method, can help individuals prioritize and pay off debt effectively. Poor credit management can have severe consequences, including damaged credit scores and difficulty obtaining future loans.

Financial Planning and Goal Setting

Financial planning involves setting financial goals and developing a roadmap to achieve them. Common financial goals include retirement planning, education funding, and homeownership.

Creating a financial plan is essential for achieving financial goals. It should include a detailed budget, investment strategy, and contingency plan for unexpected events.

Consumer Protection and Financial Literacy

Consumer protection is crucial to safeguarding individuals from financial scams and fraudulent practices. Financial literacy empowers individuals with the knowledge and skills to make informed financial decisions.

Resources and tips for protecting oneself from financial exploitation include understanding common scams, reporting suspicious activities, and seeking professional financial advice when needed.

FAQ Summary: Personal Finance Fbla Practice Test

What is the significance of budgeting in personal finance?

Budgeting serves as the cornerstone of personal finance, enabling you to track income and expenses, allocate funds wisely, and make informed financial decisions.

Why is saving money important?

Saving money provides a financial cushion for emergencies, allows you to pursue financial goals, and contributes to long-term financial stability.

How can I avoid excessive debt?

To avoid excessive debt, it is crucial to understand interest rates, use credit responsibly, and create a realistic debt repayment plan.

What is financial planning and why is it important?

Financial planning involves setting financial goals, creating a roadmap to achieve them, and making informed decisions to secure your financial future.

How can I protect myself from financial scams?

To protect yourself from financial scams, stay informed about common fraudulent practices, be wary of unsolicited offers, and report any suspicious activity.