Salary sueldo impuestos beneficio deuda delves into the intricacies of salary, taxes, benefits, debt, and salary negotiation, providing a comprehensive guide for navigating these crucial financial aspects.

This in-depth exploration examines the impact of taxes on take-home pay, the value of various employee benefits, the influence of debt on salary, and strategies for successful salary negotiations.

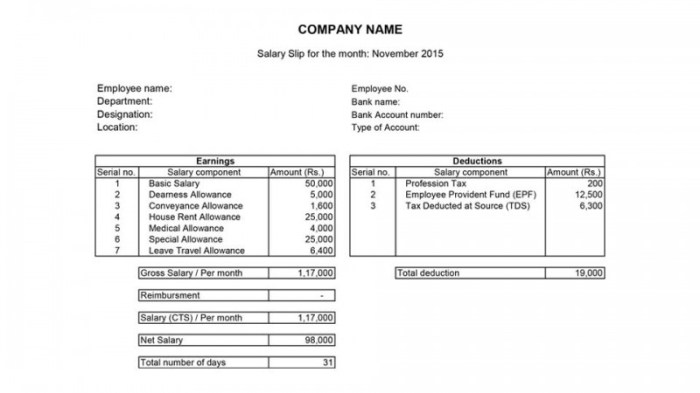

Salary and Taxes

Taxes can significantly impact take-home pay, affecting financial well-being. Understanding the different types of taxes and their implications is crucial for effective financial planning.

Types of Taxes

-

-*Income Tax

Levied on an individual’s earnings, including wages, salaries, and investments.

-*Social Security Tax

Deducted from earnings to fund retirement and disability benefits.

-*Medicare Tax

Contributed towards healthcare coverage for the elderly and disabled.

-*Property Tax

Assessed on real estate ownership, used to fund local services.

-*Sales Tax

Imposed on the purchase of goods and services.

Impact on Take-Home Pay

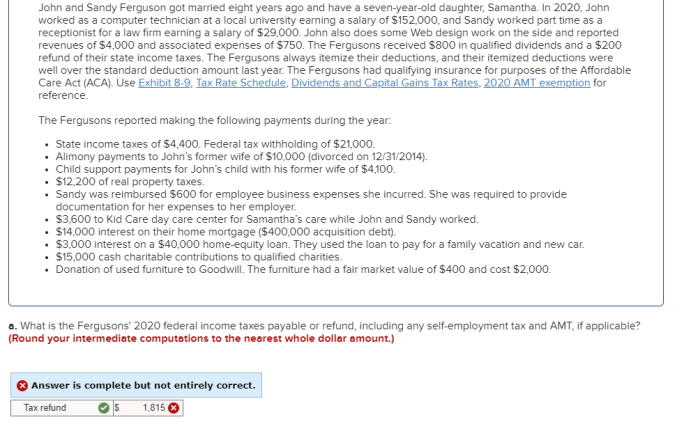

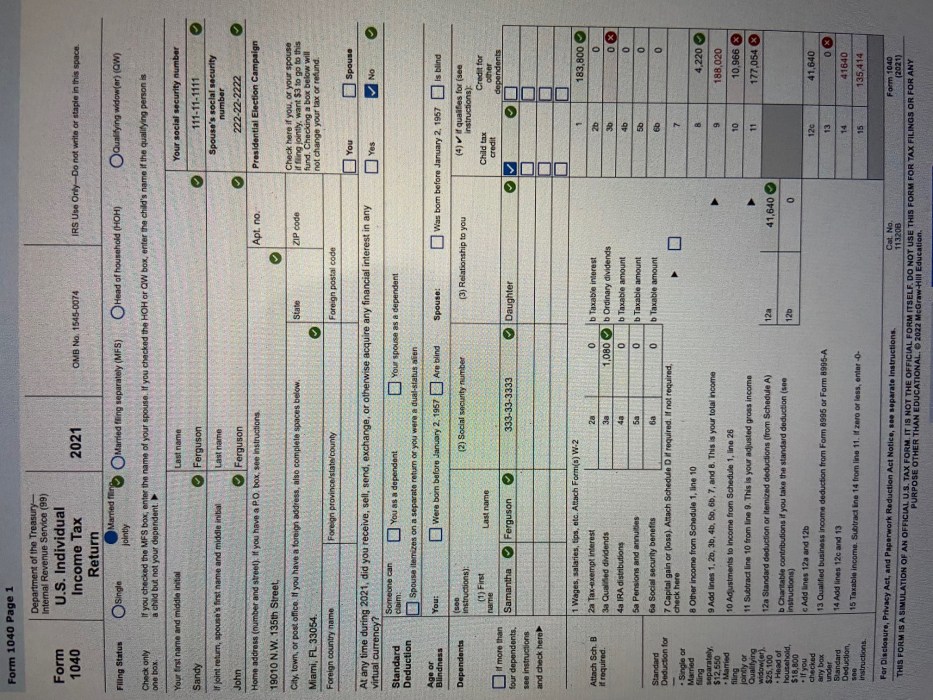

Taxes reduce gross salary, resulting in a lower take-home pay. The amount of taxes withheld depends on factors such as income level, filing status, and deductions. Understanding the tax brackets and deductions can help individuals minimize tax liability.

Strategies for Minimizing Tax Liability, Salary sueldo impuestos beneficio deuda

-

-*Maximize Deductions

Contribute to retirement accounts, such as 401(k) or IRAs, which reduce taxable income.

-*Utilize Tax Credits

Certain expenses, such as education costs or child care, may qualify for tax credits that directly reduce tax liability.

-*Consider Tax-Advantaged Investments

Invest in tax-free or tax-deferred accounts, such as municipal bonds or annuities, to reduce overall tax burden.

Salary and Benefits

Employee benefits supplement salary and play a significant role in overall financial well-being. Understanding the various types of benefits and their value is essential for informed decision-making.

Types of Benefits

-

-*Health Insurance

Covers medical expenses, including doctor visits, hospital stays, and prescription drugs.

-*Retirement Plans

Contributions made by employers and/or employees towards retirement savings.

-*Paid Time Off

Includes vacation, sick leave, and personal days, allowing employees to take time away from work.

-*Employee Assistance Programs

Provide confidential support and counseling services for employees and their families.

-*Flexible Work Arrangements

Allow employees to work remotely or adjust their schedules, enhancing work-life balance.

Value of Benefits Packages

The value of a benefits package depends on the specific benefits offered and the individual’s needs. Health insurance, for example, can provide significant financial protection against medical expenses. Retirement plans help secure financial stability in later years.

Contribution to Financial Well-Being

Benefits contribute to financial well-being by:

-

-*Reducing Healthcare Costs

Health insurance covers medical expenses, reducing the financial burden on employees.

-*Securing Retirement

Retirement plans provide a source of income during retirement, ensuring financial stability.

-*Promoting Work-Life Balance

Paid time off and flexible work arrangements allow employees to balance work and personal responsibilities.

Salary and Debt: Salary Sueldo Impuestos Beneficio Deuda

Debt can have a significant impact on salary, affecting financial stability and overall well-being. Managing debt effectively is crucial for financial health.

Impact of Debt on Salary

-

-*Debt Repayment

Debt payments, such as mortgage or car loans, reduce disposable income.

-*Reduced Savings

High debt levels can limit savings, making it difficult to build financial security.

-*Credit Score Damage

Missed or late debt payments can negatively impact credit scores, making it harder to qualify for loans or lower interest rates.

Strategies for Managing Debt

-

-*Create a Budget

Track income and expenses to identify areas where spending can be reduced or debt payments can be increased.

-*Prioritize High-Interest Debt

Focus on paying off debts with the highest interest rates first to minimize interest charges.

-*Consider Debt Consolidation

Combine multiple debts into a single loan with a lower interest rate, reducing monthly payments.

-*Seek Professional Help

If struggling to manage debt, consider consulting a credit counselor or financial advisor for guidance.

Importance of Budgeting and Financial Planning

Budgeting and financial planning are essential for effective debt management. By creating a budget, individuals can control spending, allocate funds for debt repayment, and track progress towards financial goals.

Salary Negotiation

Salary negotiation is a crucial skill for maximizing earning potential. Understanding key factors and employing effective strategies can lead to successful outcomes.

Key Factors to Consider

-

-*Market Value

Research industry benchmarks and compare salaries for similar positions in the same geographic area.

-*Experience and Skills

Highlight relevant experience, skills, and accomplishments that justify a higher salary.

-*Company Budget

Be aware of the company’s financial situation and budget constraints.

-*Negotiation Skills

Develop strong negotiation skills, including the ability to articulate value, compromise, and build rapport.

Tips for Successful Negotiation

-

-*Prepare Thoroughly

Gather data on market value, company financials, and your own experience.

-*State Your Expectations Clearly

Communicate your desired salary range with confidence.

-*Be Willing to Compromise

Negotiation often involves finding a mutually acceptable solution.

-*Focus on Value

Emphasize how your skills and experience can benefit the company.

-*Be Patient and Persistent

Salary negotiations can take time and effort. Stay patient and persistent in pursuing your goals.

FAQ

What are the most common types of taxes that affect salary?

Income tax, social security tax, and Medicare tax are the most common types of taxes that affect salary.

How can I minimize my tax liability?

There are various strategies for minimizing tax liability, such as maximizing tax-deductible contributions, utilizing tax credits, and exploring tax-advantaged investment options.

What are the different types of employee benefits?

Employee benefits can include health insurance, dental insurance, vision insurance, paid time off, retirement plans, and stock options.

How can I negotiate a higher salary?

To negotiate a higher salary, it is important to research industry benchmarks, prepare thoroughly, and be confident in your worth.